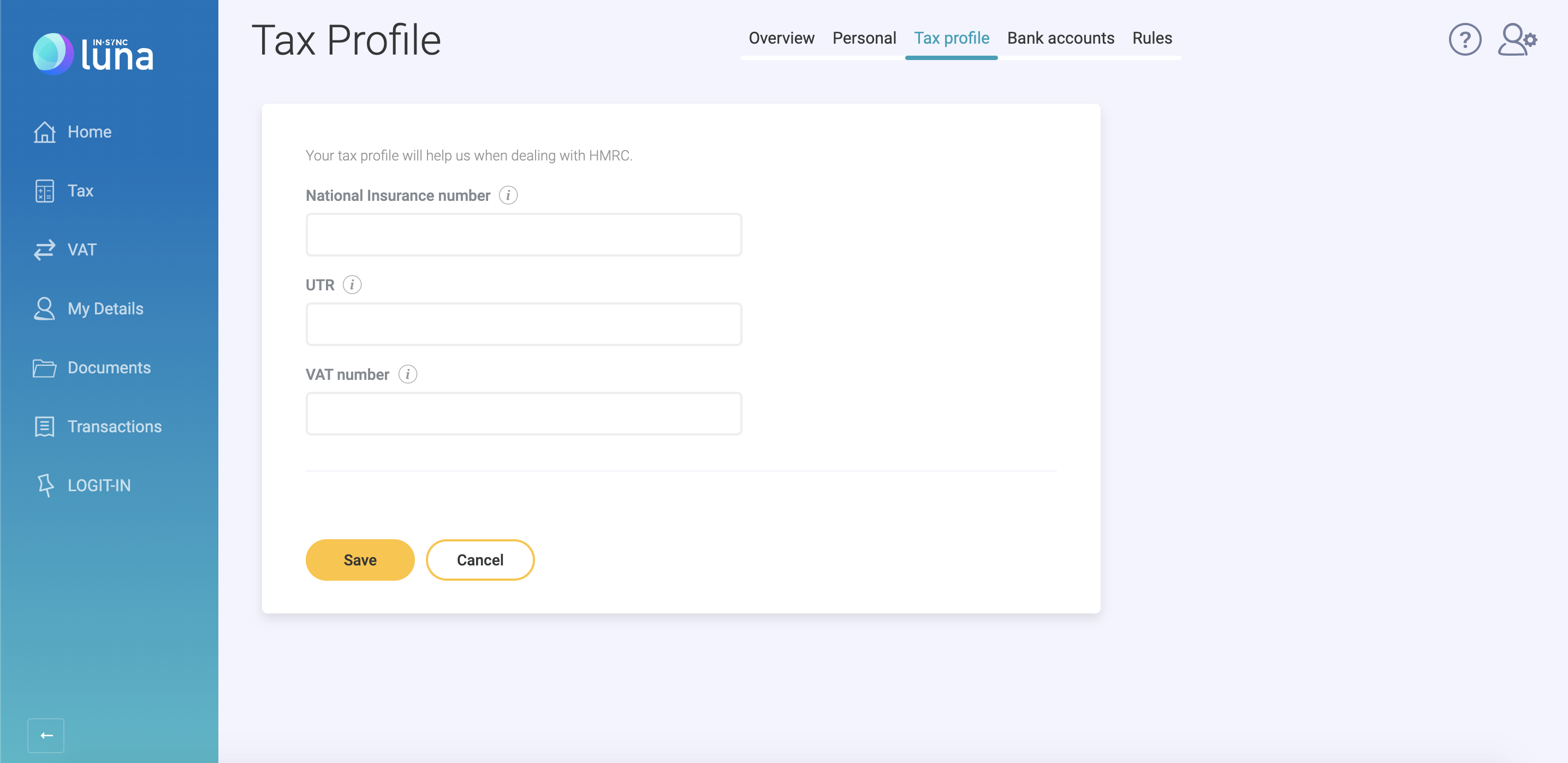

To update your tax profile in Luna on desktop, go to the "My Details" section on the left hand side menu and then click "Tax profile" in the tabs that are displayed along the top.

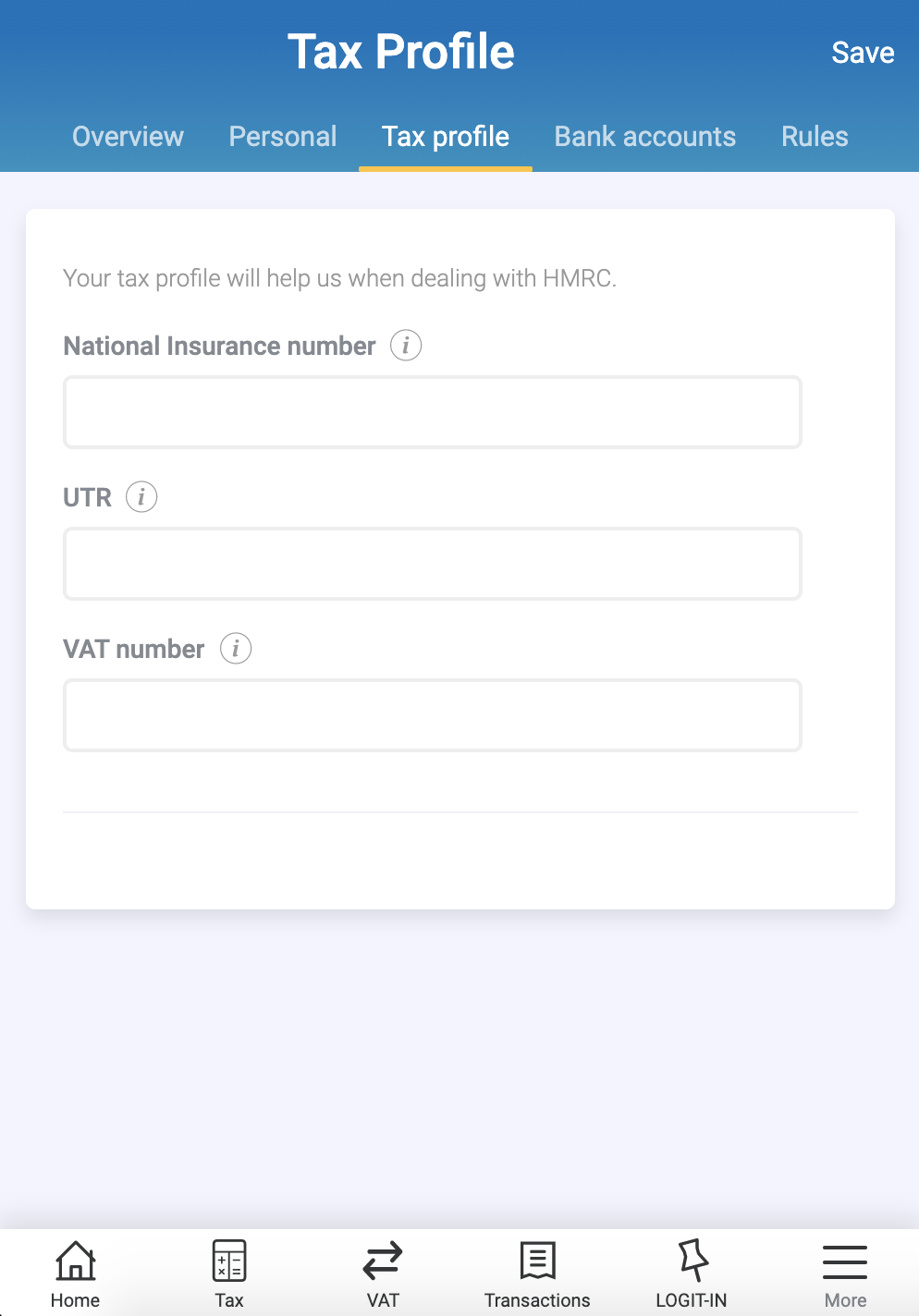

For mobile, you will need to click on the "more" burger menu in the bottom right hand corner then choose "Settings" then "Tax profile".

Now you can fill in the relevant tax information and submit it to Luna.

Below you can find out more about what each field means:

National Insurance Number

You can find your National Insurance number on your payslip, P60, or letters about tax, pensions and benefits from HMRC.

UTR

A UTR number is a unique taxpayer reference number. It is 10 digits long and you are given one by HMRC when you register for self-employment.

VAT number

If you are VAT registered, HMRC will have sent you a VAT number e.g. 253 6013 31