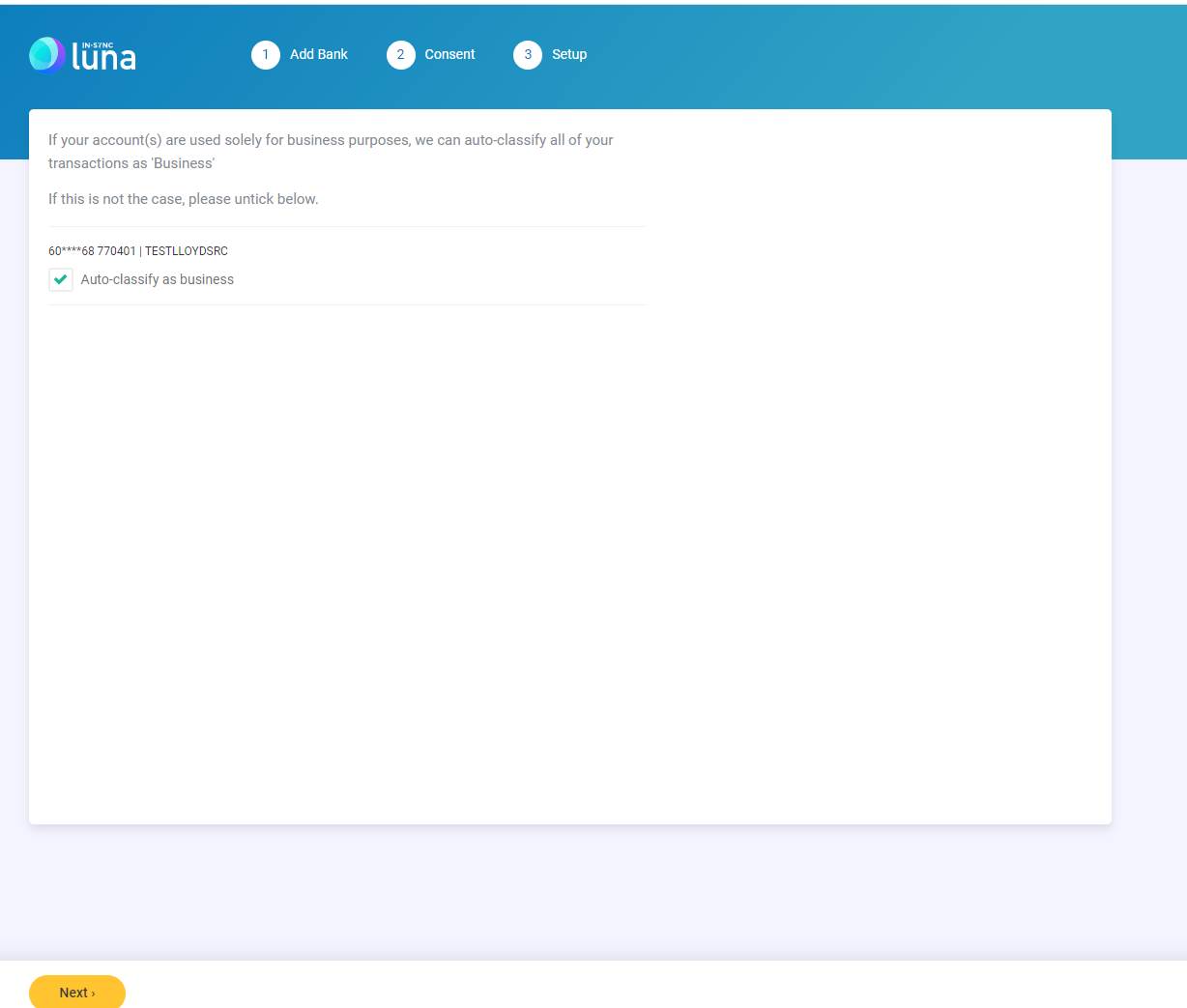

When you first connect your bank account to Luna you will see the following screen offering to auto-classify all of your transactions as 'Business'...

Important: If your account(s) are for business purposes only, then you should make sure the "Auto-classify as business" checkbox is ticked. This means you won’t need to manually classify your expenses in LUNA as it will do it for you.

If you have a mixture of personal AND business expenses on your bank account then you should un-tick the "Auto-classify as business" checkbox. This means you will be able to manually classify your transactions in LUNA. An example might be a £45 Tesco shop as a 'Personal' expense and a £100 Screwfix shop classified as 'Business'.

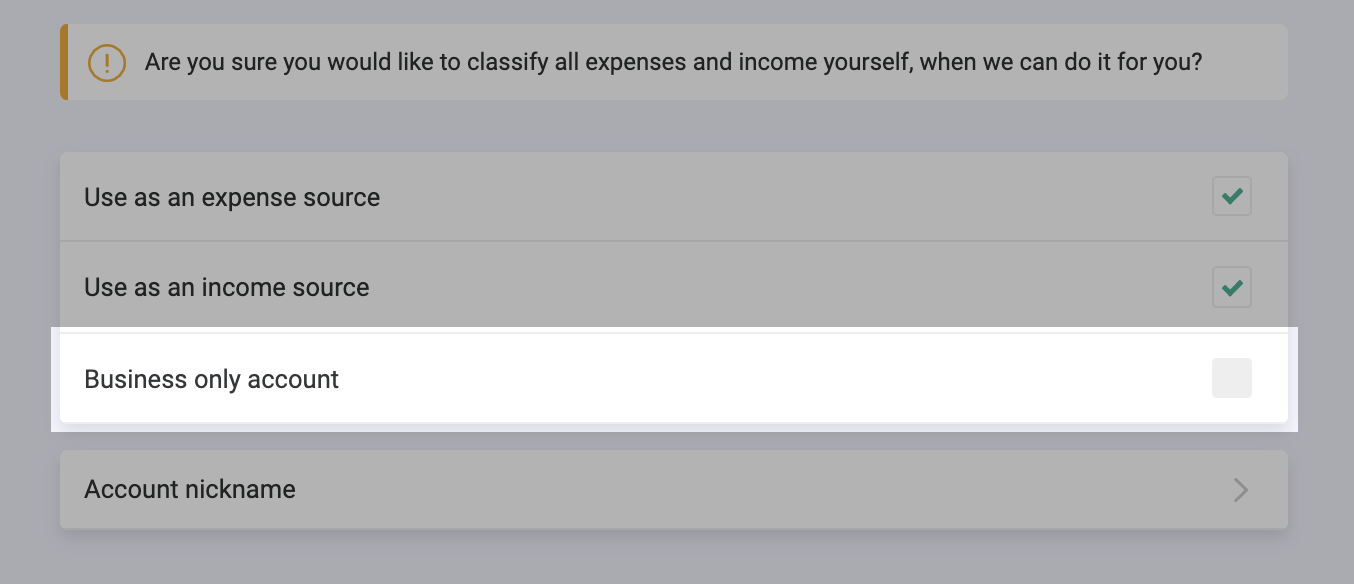

You can also auto-classify all of your expenses as business only at any point by visiting "Settings" > "Bank accounts" and then clicking on your bank panel. You will then see the following screen...

Simply tick the box on the "Business only account" and click save so Luna can make all future expenses classified as business. Once activated you will no longer need to manually classify your expenses as Luna will do it for you.

Important: If you wish to deselect this option in the future and return to manually classifying expenses you will need to go to Settings page and deselect "Business only account".

Linking your bank with LUNA, means our Tax Team have all the latest information about your expenses, and you can relax.