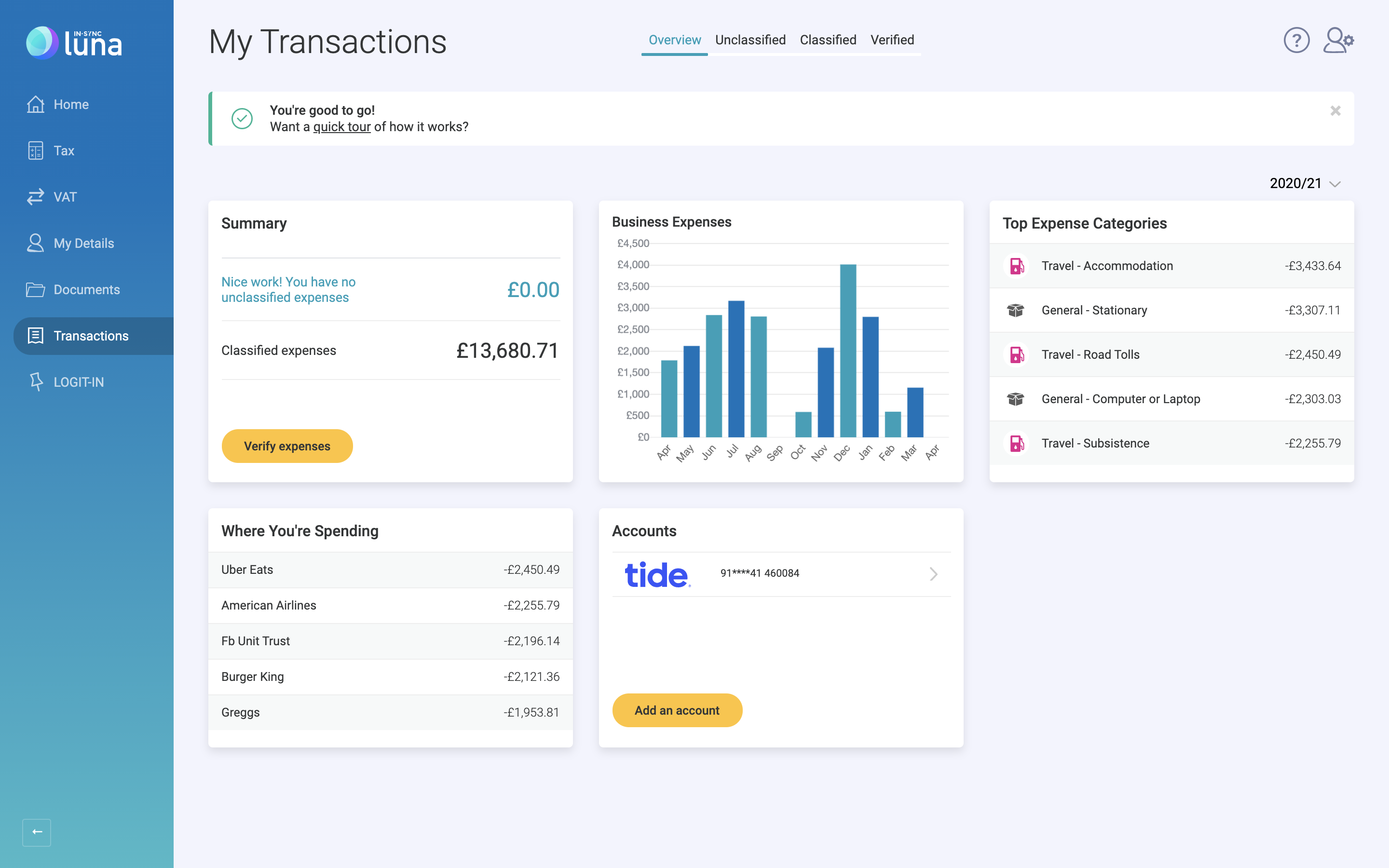

Open Banking allows you to see all your finances in one place and make it easier to manage your money. Adding your bank account to Luna gives you the benefit of classifying your transactions online, speeding up the process of submitting your tax return and getting a rebate.

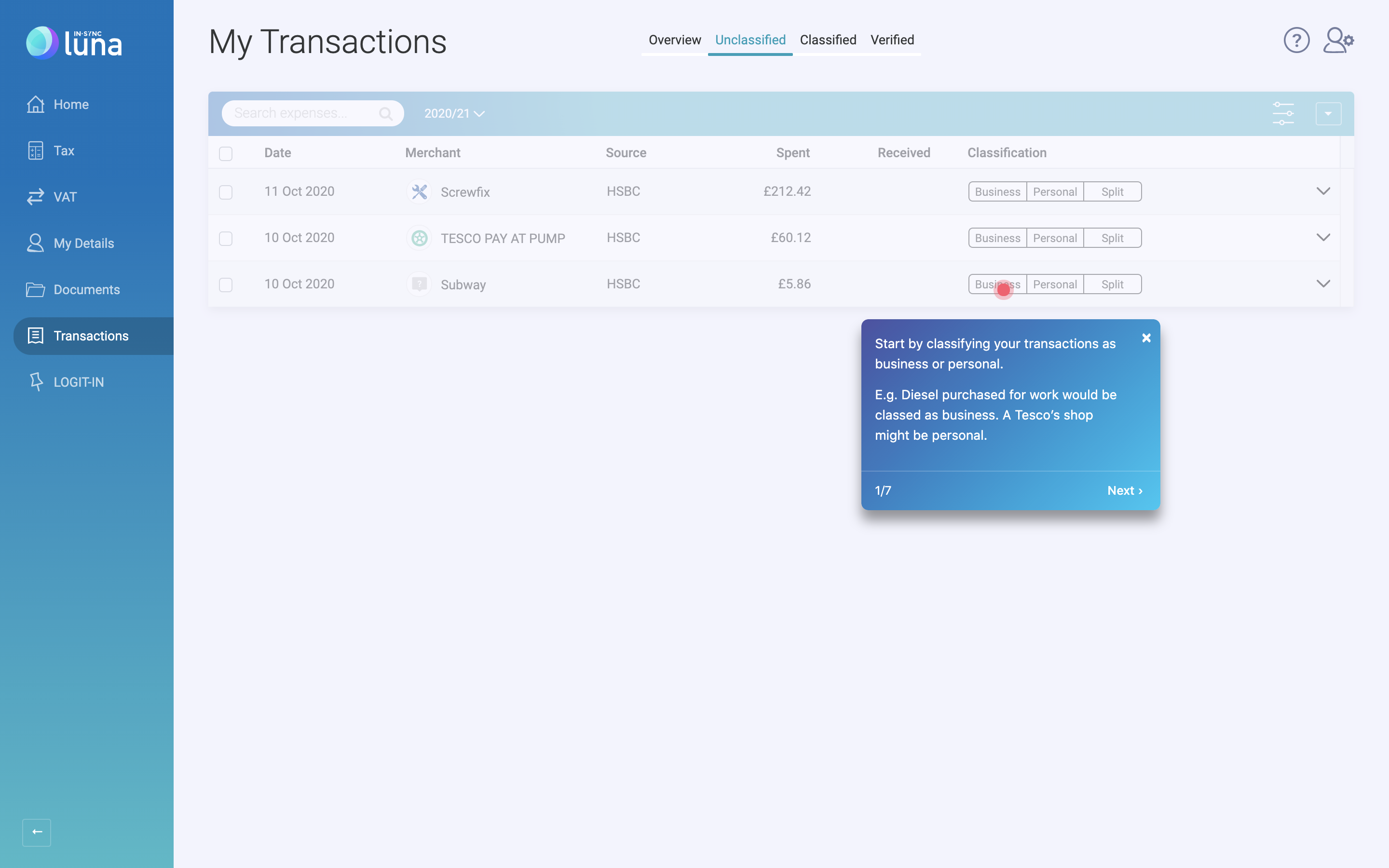

Start by classifying your transactions as business or personal. An example might be fuel that you’ve purchased for work, this could be classed as Business. A weekly Tesco’s shop would be personal.

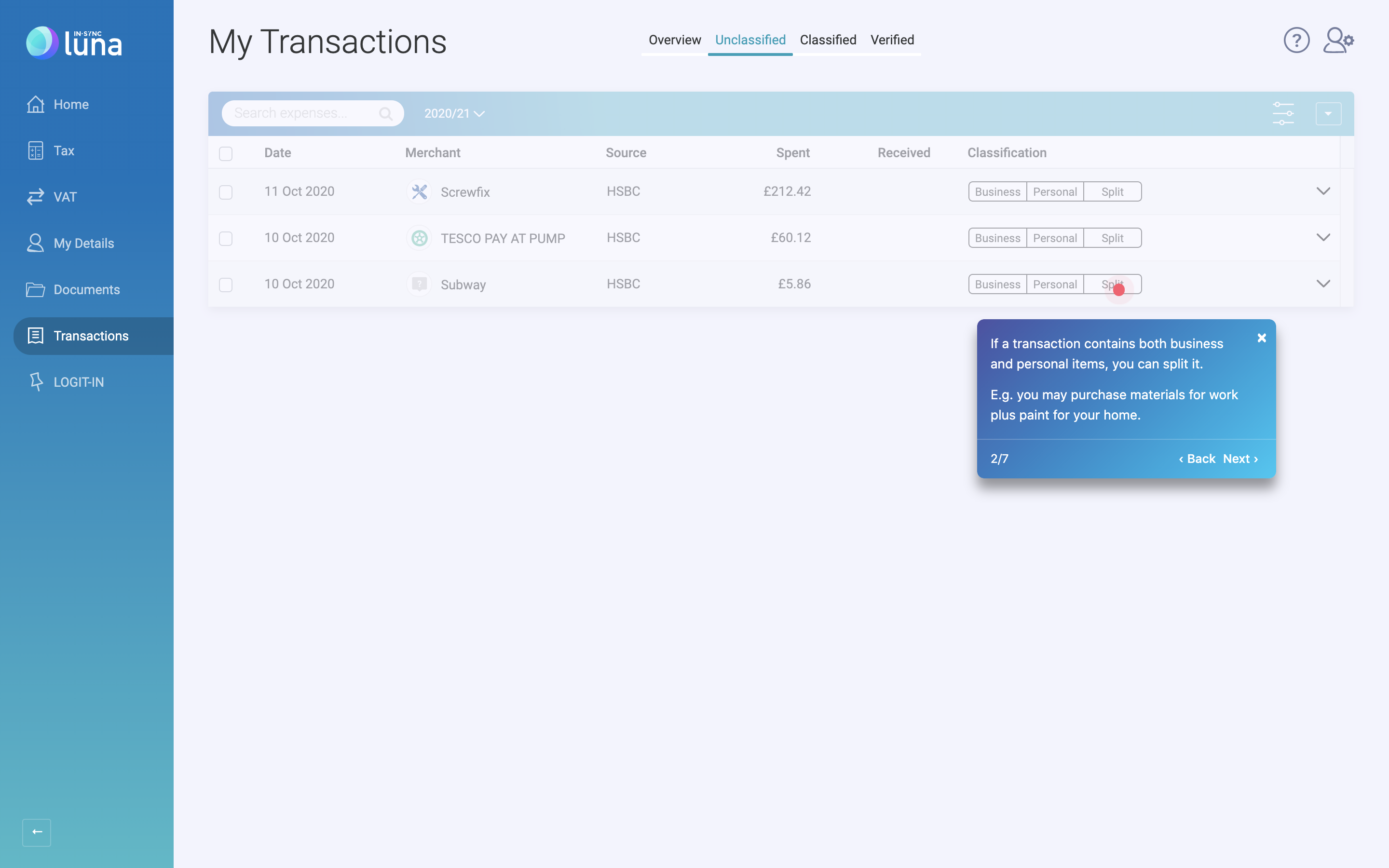

If a transaction contains both business and personal items, you can split it. For example, you may purchase materials for work and some paint for decorating your home.

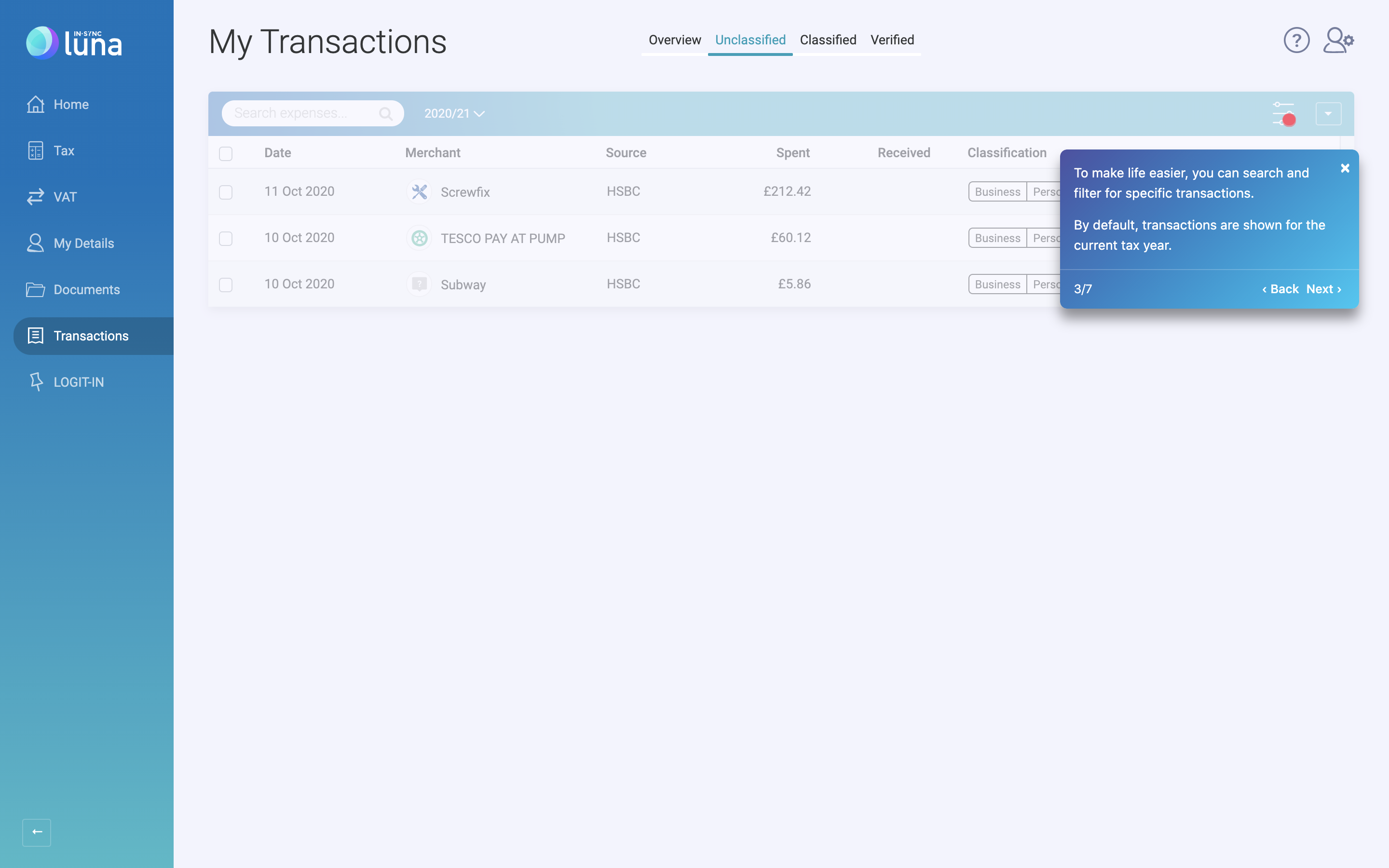

To make life easier, you can search and filter for specific transactions. By default, transactions are shown for the current tax year.

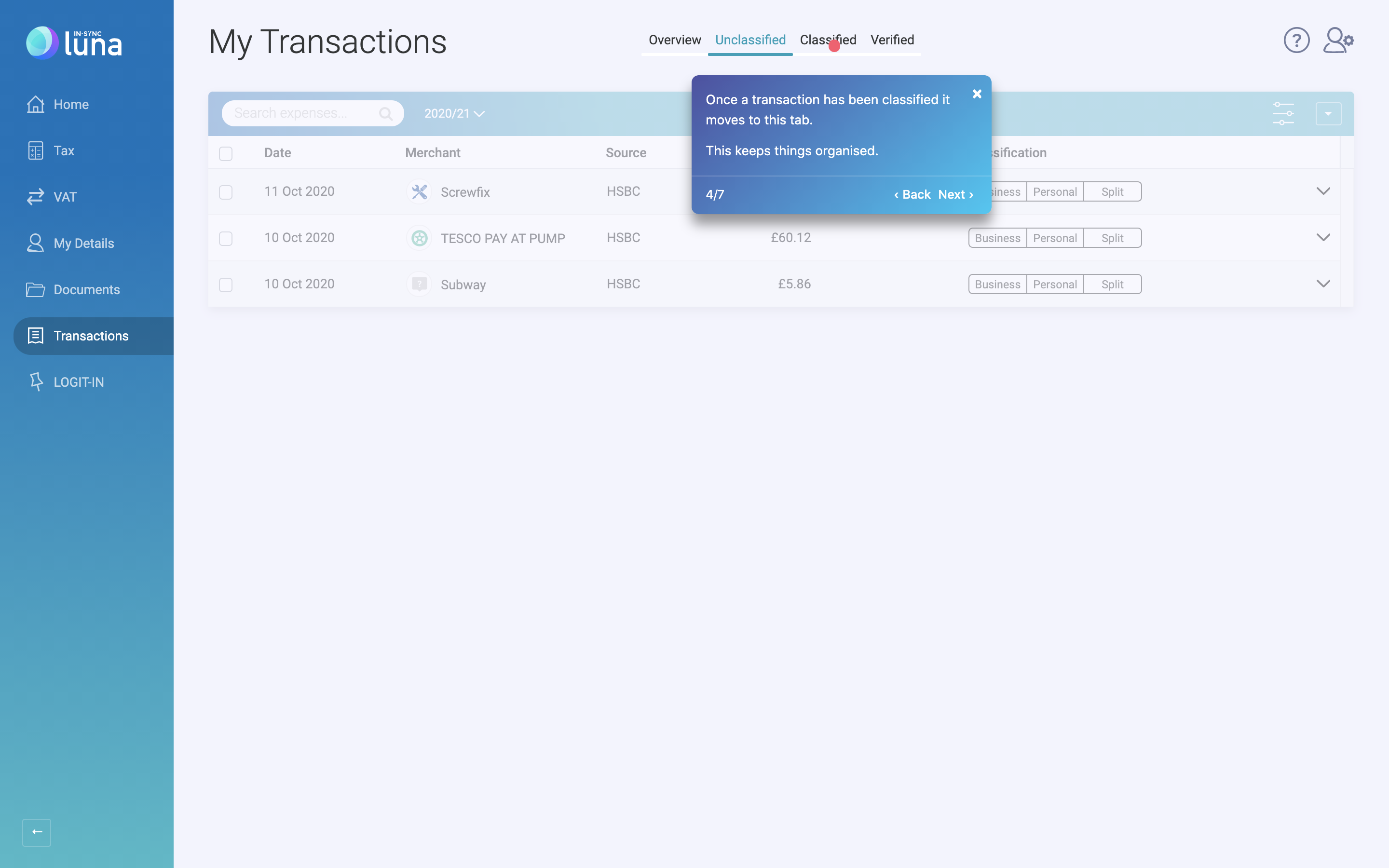

To keeps things organised. Once a transaction has been classified it moves from the unclassified tab to the classified tab.

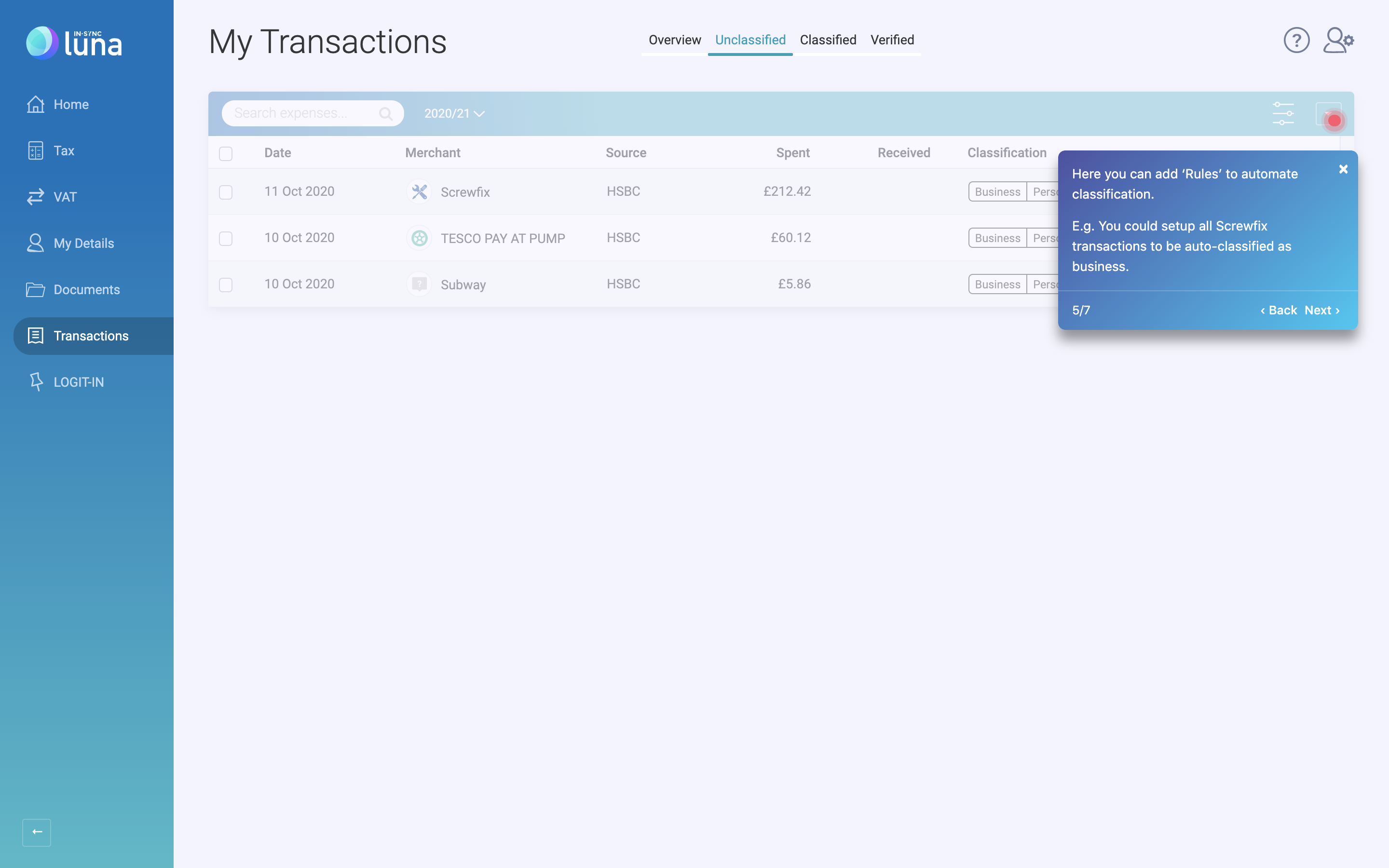

Inside the dropdown menu you have the option of adding “Rules” to automate classification. A good example would be adding a rule that auto classified all “screwfix” transactions as business.

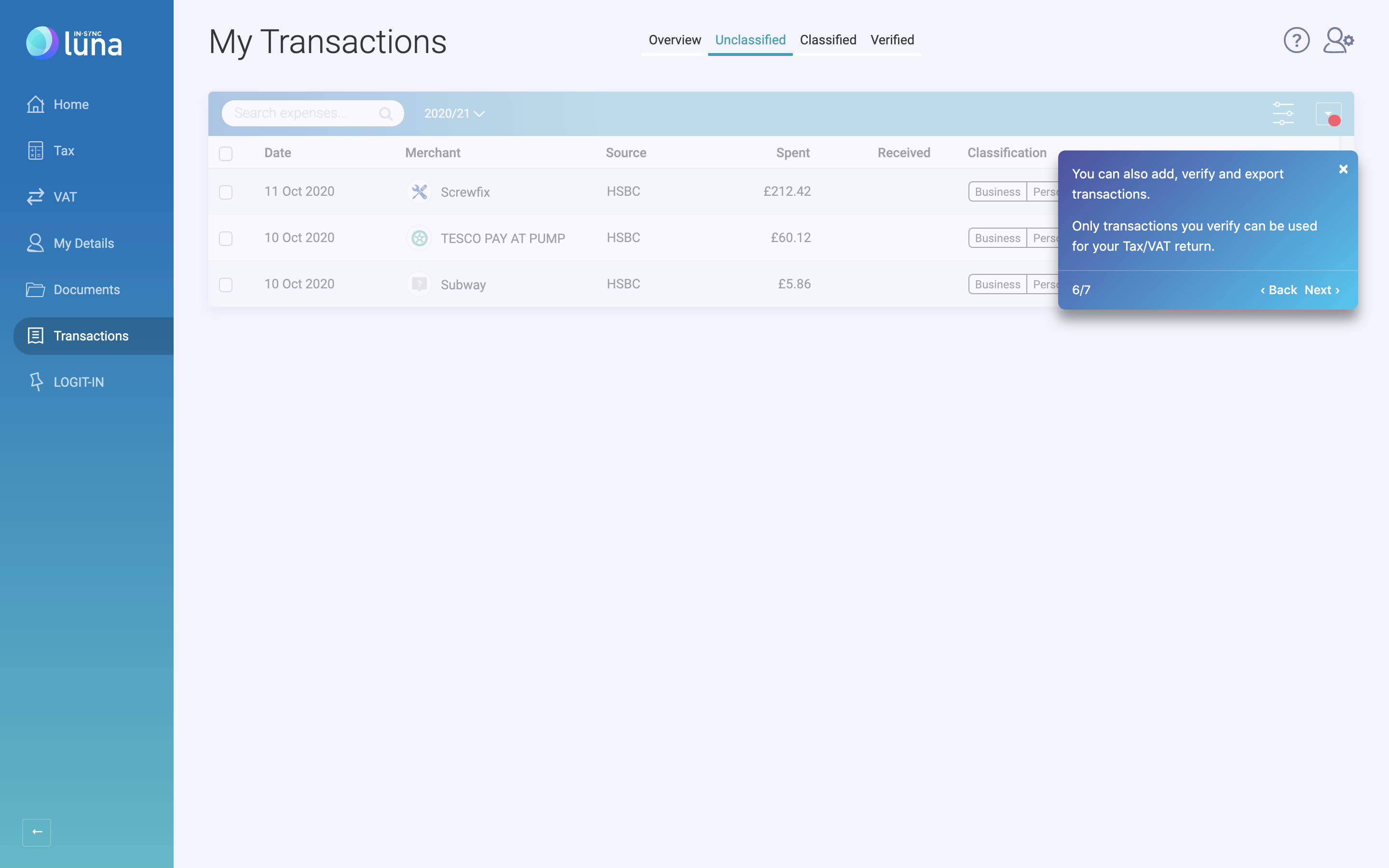

You can also choose to add, verify and export transactions. Only transactions you have verified can be used for your Tax/ VAT return.